Why You Need An Emergency Fund | And How I Saved My First $1,300 Towards It

/Unexpected things happen all the time and when those things cost, it can be very scary. You have to scramble to figure out what to do and how you can rearrange your life to fix this crisis. The stress from all of this can be unbearable.

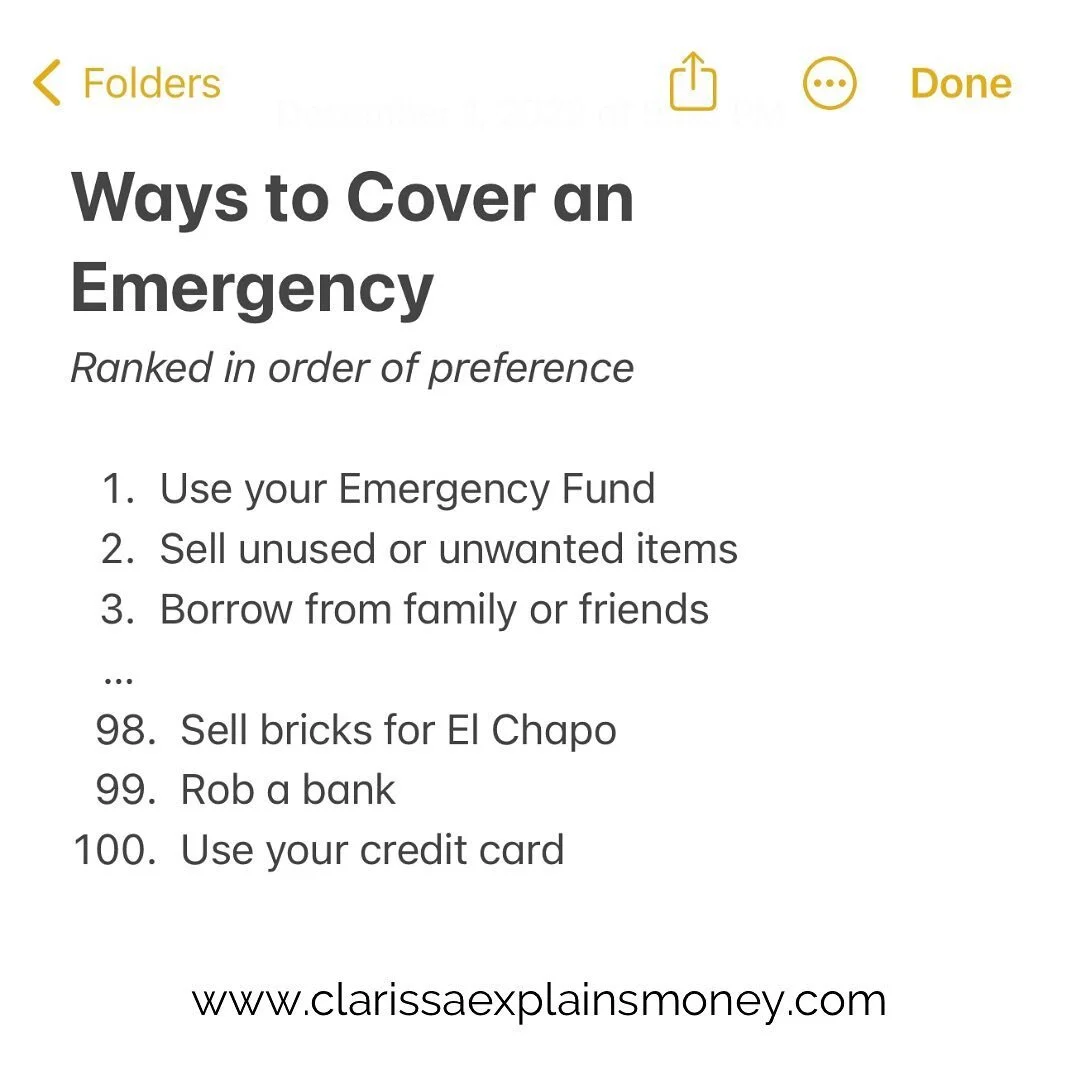

Here's what could happen if you don't have an emergency fund:

Have to borrow from your 401K and take away from your retirement

You make your rent or mortgage payment late

You overdraw your checking account and drown in late fees

Don't let this be you. Stash enough money away to cover those unexpected expensive crisis.

WHAT IS AN EMERGENCY FUND?

An emergency fund is just that, a fund for emergencies. It is money set aside to cover expenses that happen unexpectedly. This could be for Medical emergencies, job loss, car repairs, or home repairs. An emergency fund is essential to avoid going into debt to pay for things that weren't in your budget.

DO I NEED AN EMERGENCY FUND?

Ask yourself these questions to determine if you need an emergency fund:

If my car broke down, can I afford to get it fixed? Can I afford to pay for a rental week?

If the kids have an accident and need to go to the ER, can I foot that bill?

If I lose my job, can I afford to pay all my bills in full and on time?

If something breaks in my house today, do I have the money to fix it?

If you answered "No" to any one of those questions then you need an emergency fund.

HOW MANY EMERGENCY FUNDS DO I NEED?

I currently have 3 emergency funds:

Medical Emergencies (HSA)- $1,200

Entrepreneur (3 months worth of expenses)- $9,000

Home Repairs- $1,560

I chose these categories because these are the things I feel I need to be prepared for in my current situation. I chose medical emergencies because I have 2 children, one in which is a boy who loves to jump off things and play rough. I need to be sure I can cover whatever he gets into. The $1,200 amount is funds added to the HSA from my insurance plan.

Notice I didn't name my second fund "job less", instead I named it Entrepreneur. Why is that? I believe that death and life are in the power of the tongue. You should be careful what you say and think about yourself because we can speak these things into existence. That's a whole 'notha blog post. COMING SOON! I came up with the $9,000 amount by adding up my monthly expenses and multiplying it by 3.

I am a new homeowner and although my house is still in very good shape, its important to me to have money to cover any repairs that may arise. This is a percentage of

How I Saved Over $1,300 For My Emergency Fund

I saved over $1,300 for my first emergency fund in 6 months.

Here's how I did it and how you can do it too:

I decided what I wanted to save for

Created a savings plan

Cut one unnecessary expense

Increased my savings on the things I bought

Any extra money I had left over went to my goal

I Decided What I Want to Save For

The first thing I wanted to save for was my Entrepreneur fund. My idea of financial freedom is not allowing a job to hang employment over my head. I wanted to feel secure in knowing that if I left to do something I loved, I would have 3 months to figure it out.

2. Created A Savings Plan

I used the 26 Week Savings Plan which helped me to save $1,375 in 1 year. Get the savings plan from our Budget Planner. I tried this plan in the past and failed. I was able to be successful with these strategies.

3. Cut Out One Unnecessary Expense

I used to get a mani/pedi bi-weekly, that would cost me about $57 each visit. I decided that although I love treating myself, that was way too much money when I was trying to save for other things. I cut out this expense and did my own mani/pedi at home. It was actually a nice break from the nail salon. I was able to have some alone time with wine, music, and snacks.

4. Increased My Savings On The Things I Bought

I was determined to save as much as I can on everything I bought and all my savings went to my emergency fund. Here's are some of the ways I saved:

Rakuten: I went grocery shopping and picked up items that I needed from my grocery list. I saved the receipts and logged onto Rakuten where I got cash back for the items I bought. Sign up with my exclusive link and get $20 in cash rewards.

Rakuten: I am an avid online shopper. I purchased my children's school clothes, vacuum cleaner, living room furniture, and anything else I could buy online and ordered it through Rakuten. Sign up with my exclusive link and get $10 after your first purchase.

4. Left Over Money Was Applied To My Goal

After paying all my expenses, saving set aside, and my wants, I sometimes had money left over. Any additional funds I put towards the emergency fund.

Final Thoughts

Everyone needs an emergency fund, if not for a specific emergency than for peace of mind. These strategies are proven to work because I did it!